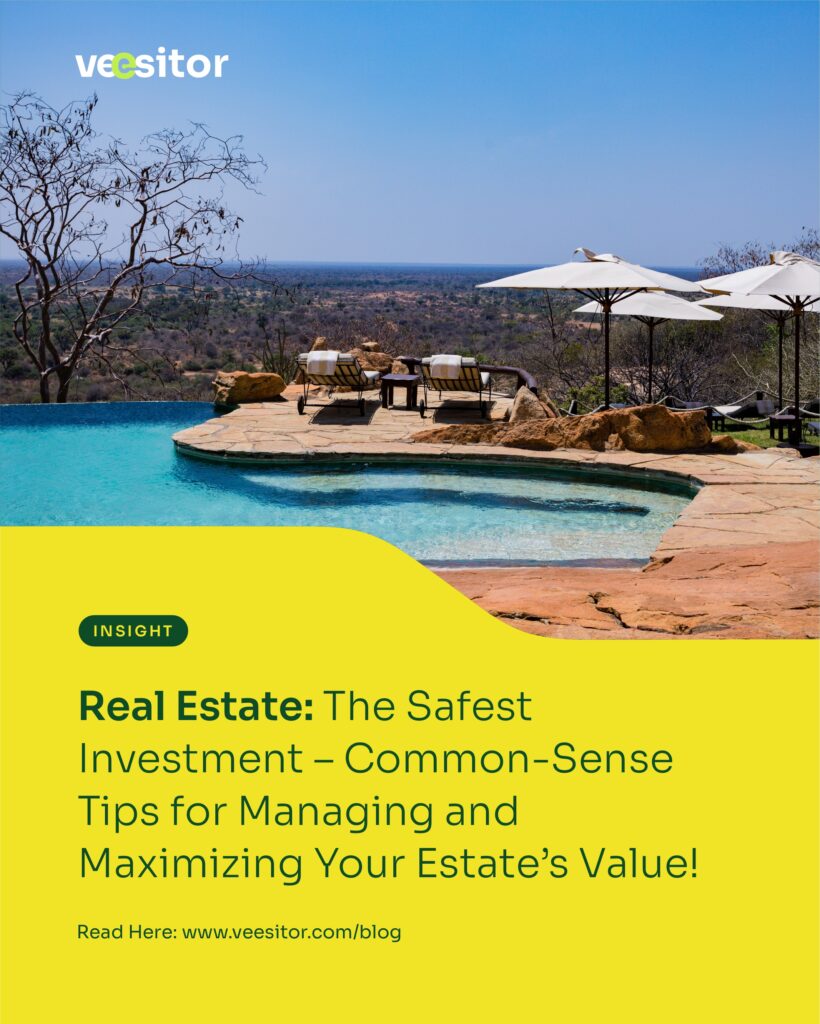

Alright, let’s get real about something that’s been a rock-solid investment for ages—real estate. Franklin D. Roosevelt called it: “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.”

Now, if that’s not a mic drop, I don’t know what is. So let’s break this down and talk about how you can make sure your estate isn’t just safe, but seriously profitable. I’m talking common-sense strategies that anyone can follow. Ready? Let’s go!

1. Why Real Estate is a Safe Investment

First things first—why is real estate considered such a safe bet? Unlike stocks, crypto, or whatever other trendy assets are out there, land and property are real. You can see them, touch them, and—most importantly—they don’t disappear overnight because of some market glitch or company scandal. FDR knew what he was talking about.

Real estate holds value because it’s always in demand. People need places to live, work, and build. And when you manage that property well, you’re sitting on a goldmine.

2. Making Wise Purchase Decisions

Buying real estate isn’t like grabbing the latest iPhone—you’ve gotta use your head. Location is everything. You’ve heard it before, but I can’t stress it enough. Buying in the right area, with a little foresight, is like getting in early on a stock that’s about to pop.

You don’t need to be Warren Buffet to make smart moves. Just do your homework. Look for spots with growth potential—maybe there’s a new highway being built nearby, or the local job market’s heating up. Be strategic, and you’ll be sitting on a property that appreciates in value over time.

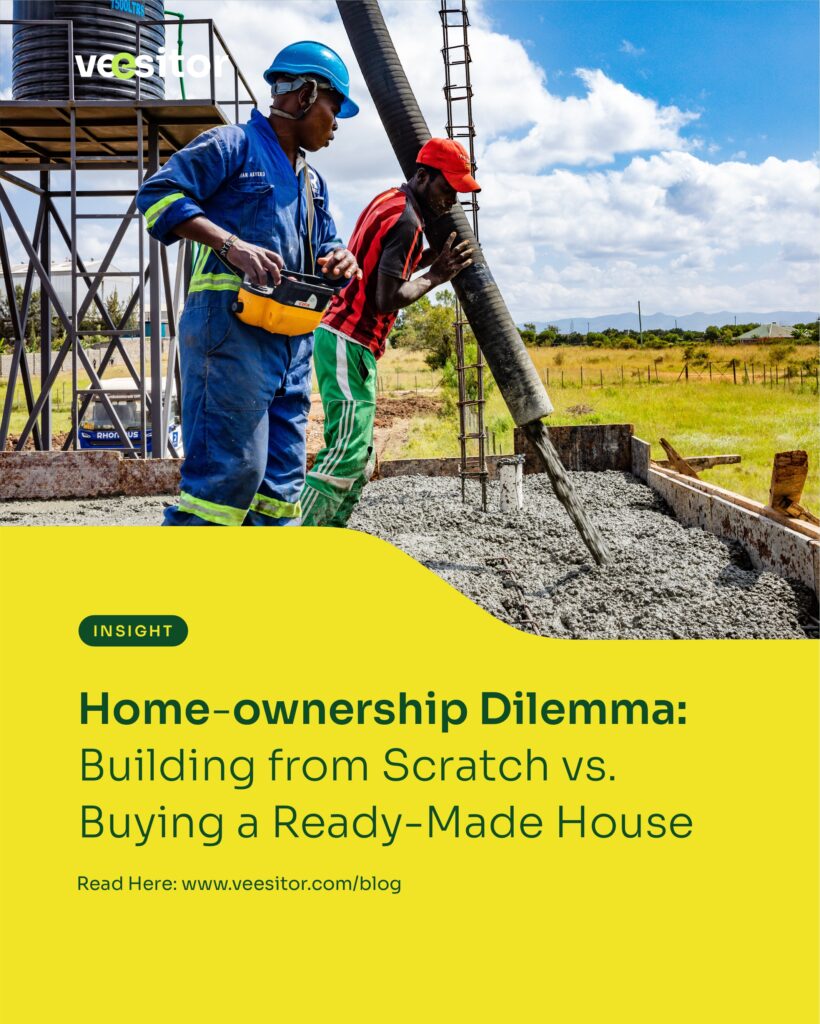

3. The Importance of Financial Responsibility in Real Estate

Here’s where most people mess up—they think, “I’ll just finance the whole thing and pay it off later.” Bad move. I mean, yeah, not everyone can buy in full right away, but minimizing debt is the way to go. The less you owe, the more you own. It’s as simple as that.

Think of paying for real estate like investing in your future self. The more equity you have, the less stress you’ll carry, and the quicker you can cash in on any potential profits.

4. Managing Your Estate with Care

Once you’ve got the property, the work isn’t over—this is where you protect your investment. Imagine buying a classic car and never changing the oil—sounds dumb, right? It’s the same with real estate. You have to manage it well if you want it to pay off in the long run.

Stay on top of maintenance, keep the place in good shape, and don’t skimp on the small things. A little repair here and there can go a long way in keeping your property’s value high. And if you’ve got tenants? Make sure they’re happy. Happy tenants = consistent cash flow.

5. Maximizing Your Estate’s Profit Potential

Real estate isn’t just about holding onto something safe—it’s about making money, too. And to do that, you have to think long term. What are the opportunities for growth? Could you flip the property after a few years of appreciation? Maybe rent it out on Airbnb? The options are endless, but only if you manage it well from the start.

Look, FDR said it best: with real estate, you’ve got a safe investment. But if you want to turn that safe investment into a money machine, you’ve gotta play smart. Use common sense when buying, pay off as much as you can upfront, and manage that property like a pro.

Do that, and your real estate won’t just be safe—it’ll be one of the best financial decisions you’ll ever make.